Fast facts:

- The Free Application for Federal Student Aid takes about an hour to complete.

- The interest rate on subsidized and unsubsidized loans is set at 3.73% for the 2021-22 school year.

- You can usually expect the government to disburse funds about 10 days before classes start.

To figure your eligibility for federal student loans, you’ll need to fill the Free Application for Federal Student Aid, or FAFSA. You’ll need to fit federal, state, and college deadlines for aid each year, so make sure you’re tuned ongoing deadlines.

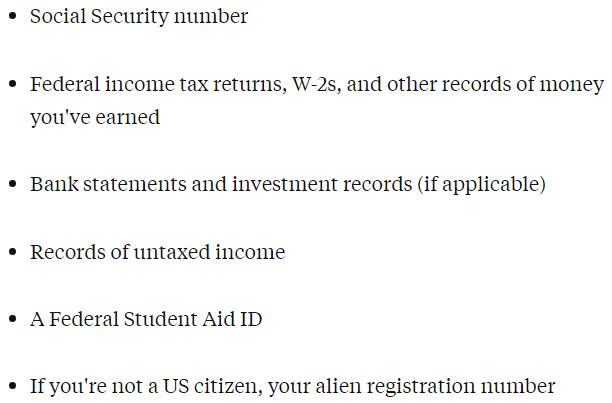

You’ll fill out this online form, which may take up to an hour to complete, and will need to have the following information handy:

About one to three weeks after you submit your FAFSA, you'll get a financial aid package that may include grants, scholarships, work-study programs, and loans. It's apparently a good idea to fill out the form even if you don't think you'll qualify for financial aid, as you never know what you may be eligible for unless you apply.

If you have the opportunity, you’ll want to take out a subsidized loan over an unsubsidized loan. Subsidized loans are made based on financial need, and the government pays the interest on your loan while you’re in school. Financial need doesn’t factor into unsubsidized loans, and interest begins to grow immediately. Both subsidized and unsubsidized loans have the same interest rate, which is set at 3.73% for the 2021-22 school year.

You’ll need to sign a Master Promissory Note if you prefer to take out a loan. An MPN is a legal document you sign to agreement to pay back your loan with interest and fees. You’ll also determine the amount of money you want to borrow and your repayment term. The government won’t distribute your loan until you sign this document.

You can generally expect your school to get your federal funds about 10 days before classes begin. You may patience a 30-day delay if you are both a first-year student and a first-time borrower.